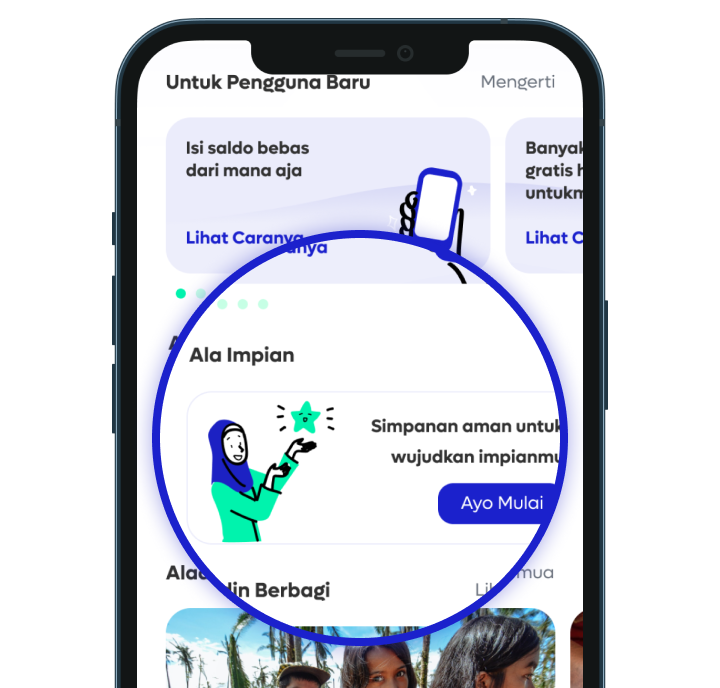

Ala Impian

Bagi Hasil Lebih Tinggi, Makin Cepat Raih Mimpi!

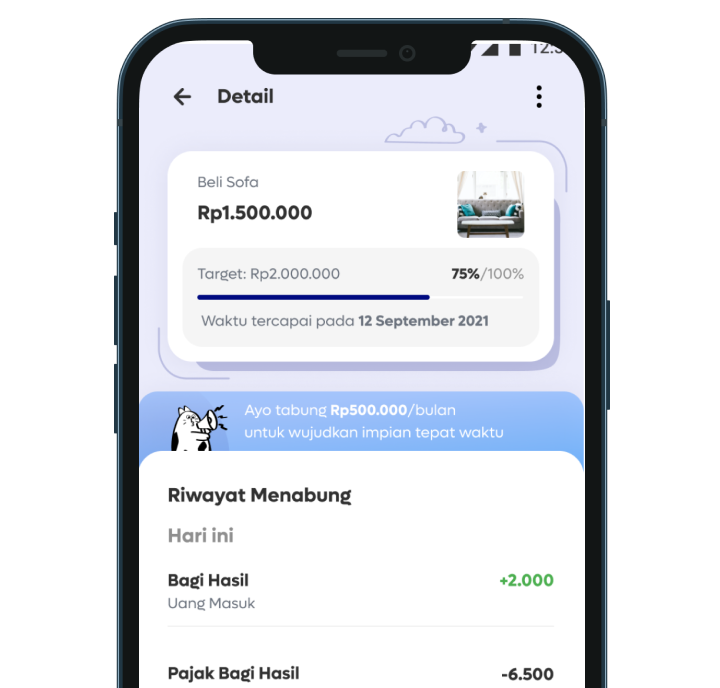

Ala Impian punya nisbah 80% dengan indikasi bagi hasil 8%, lho! Makin untung deh menabung di Ala Impian karena bagi hasilnya lebih tinggi.

Ala Impian juga menggunakan prinsip syariah yang bikin berkah dan fleksibel karena bisa kamu tarik kapan aja. Bukan cuma bikin nabung jadi mudah, tapi juga jadi nyaman di hati

Ala Impian

for All Your Plan

Whatever your dream, you can plan it with Ala Impian. An easy way to manage your finance for you who dream big.

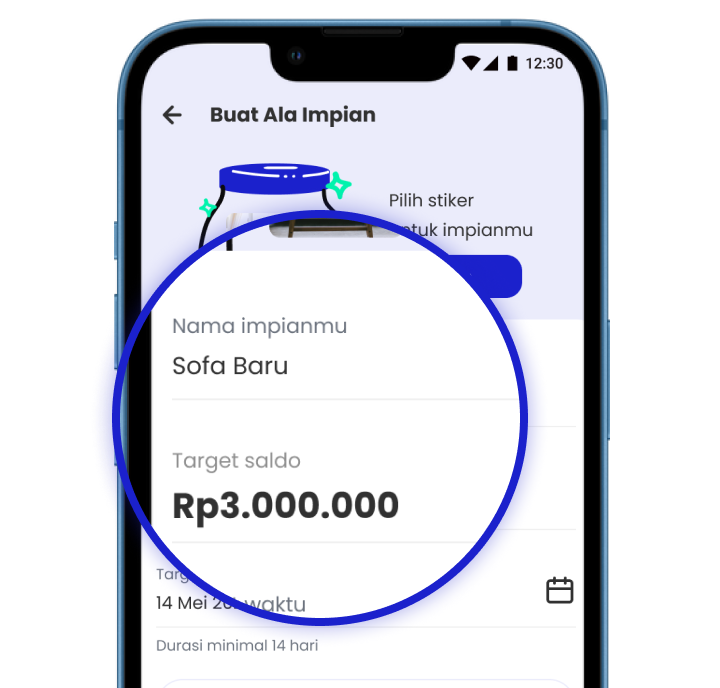

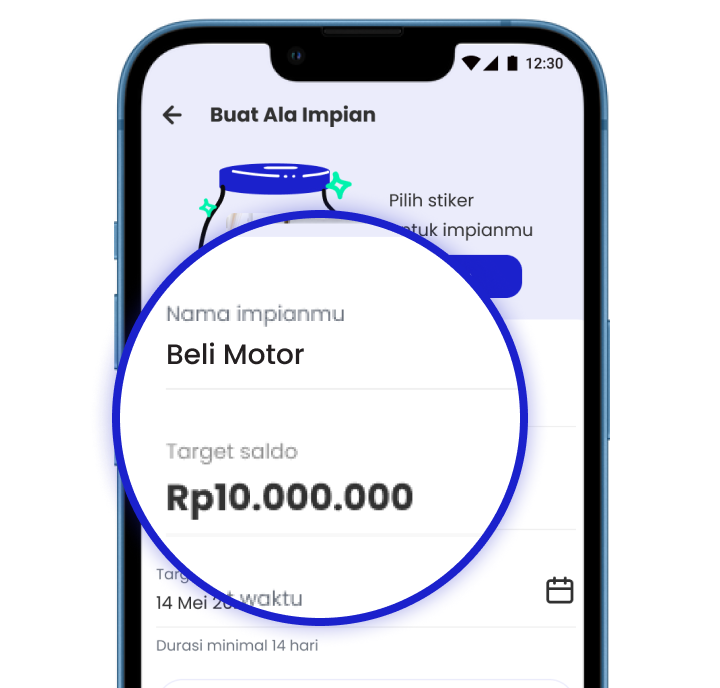

Manage Your Target Limit

No matter how much you need, set it yourself with Ala Impian. Save more, plan more.

No Rush, Manage Your Dream In Your Own Pace

Manage your saving duration and reach your dream within your own pace.

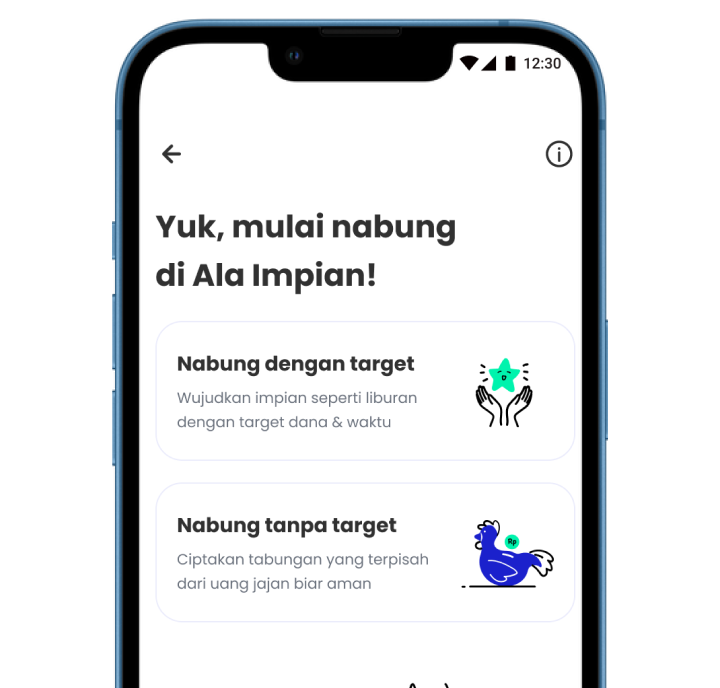

Memberikan Kemudahan

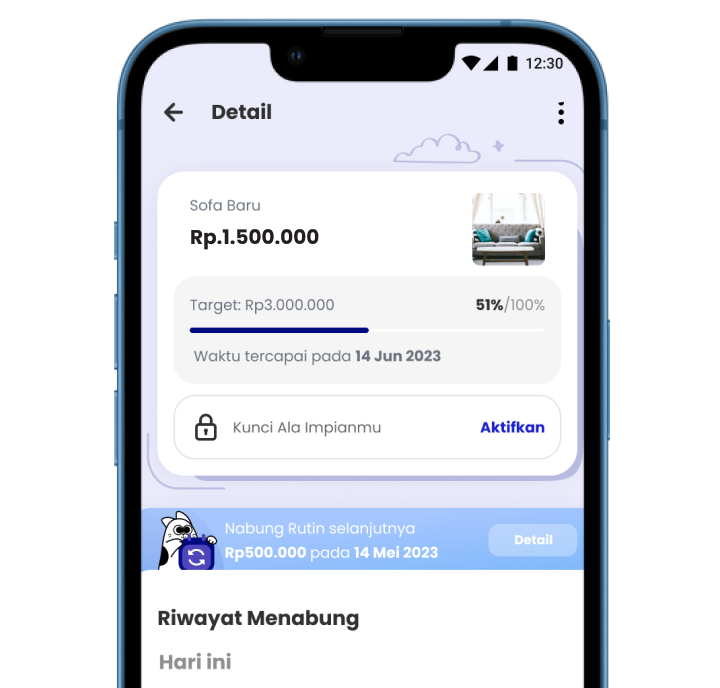

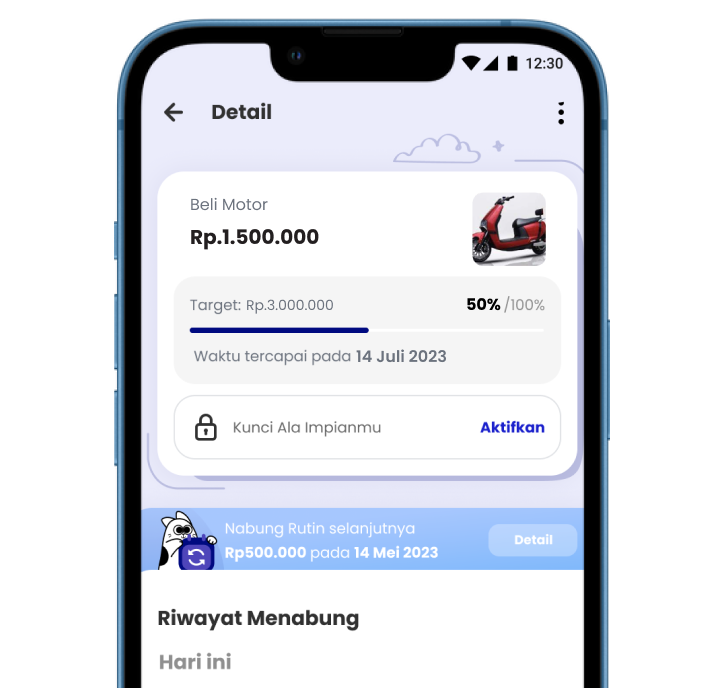

Kamu dapat aktifkan Nabung Rutin dan Kunci Impian agar tabungan kamu tercapai lebih maksimal dan tepat waktu.

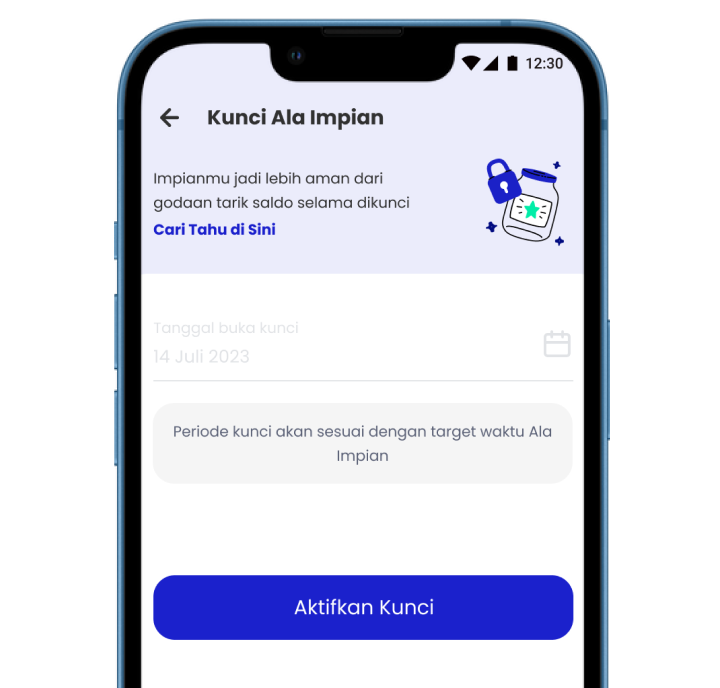

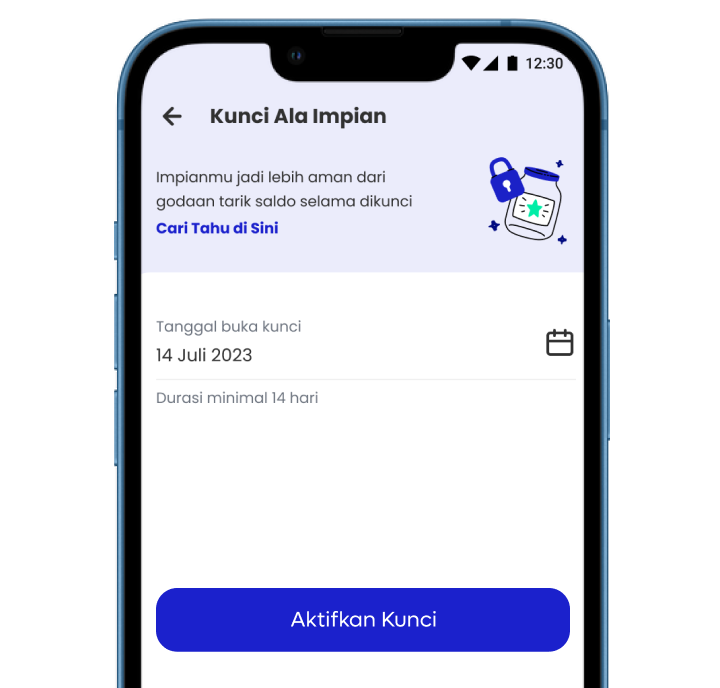

Fitur Kunci Impian bantu kamu lebih disiplin nabung tanpa drama!

Gak ada lagi drama tabungan ‘gak sengaja terpakai’, karena sekarang kamu bisa atur untuk kunci tabungan buat impian kamu dengan Fitur Kunci Impian!

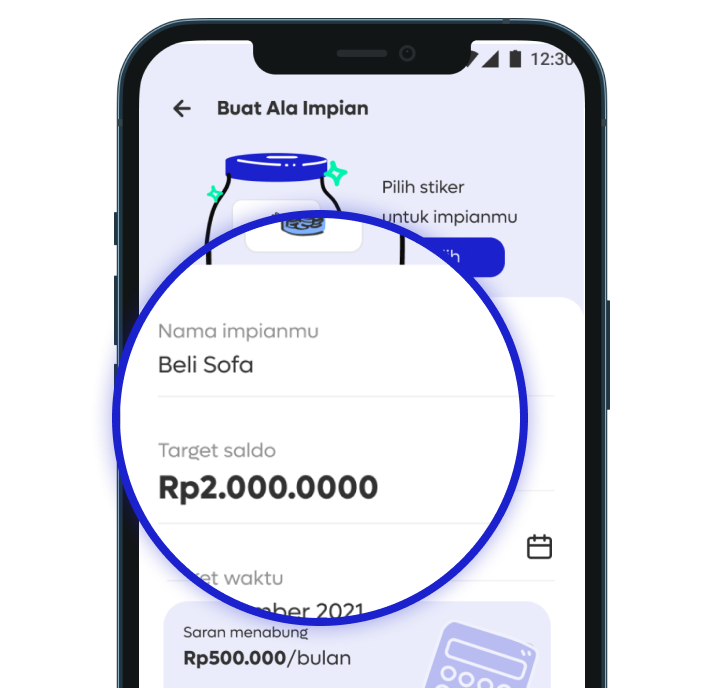

Simple Way to Save Up For Your Goals

All you need to do is follow these steps to open your savings account!

Masukkan detail rekening, dan klik Buat Ala Impian

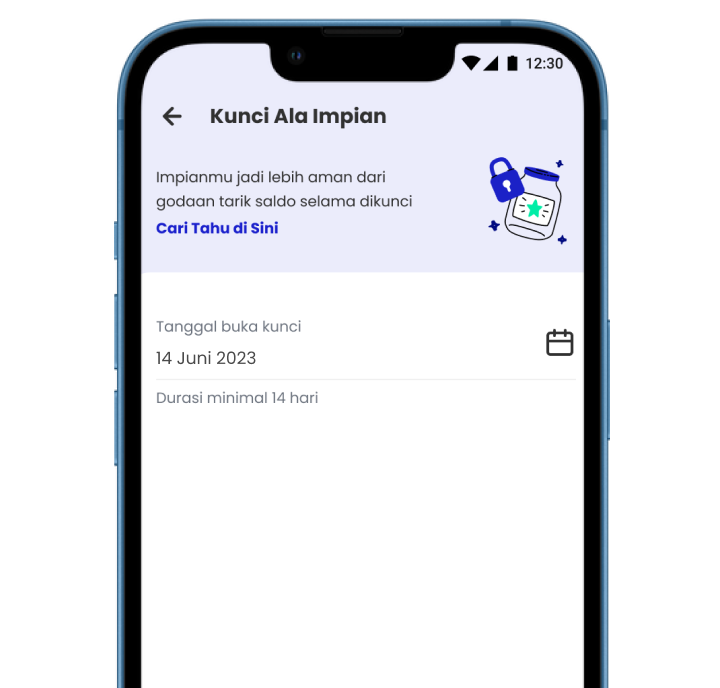

Untuk kamu yang sudah punya Ala Impian, dan ingin mengaktifkan fitur kunci impian, aktifkan fitur kunci impian di menu “Kunci Impian” pada halaman detail rekening atau dari menu “Lainnya”

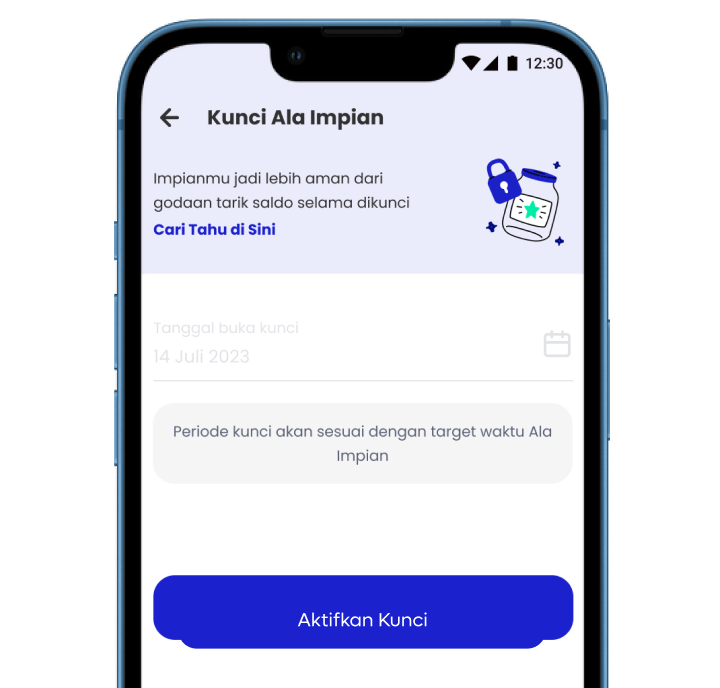

Klik “Aktifkan”. Untuk Ala Impian dengan Target, tanggal buka kunci adalah tanggal target impianmu.

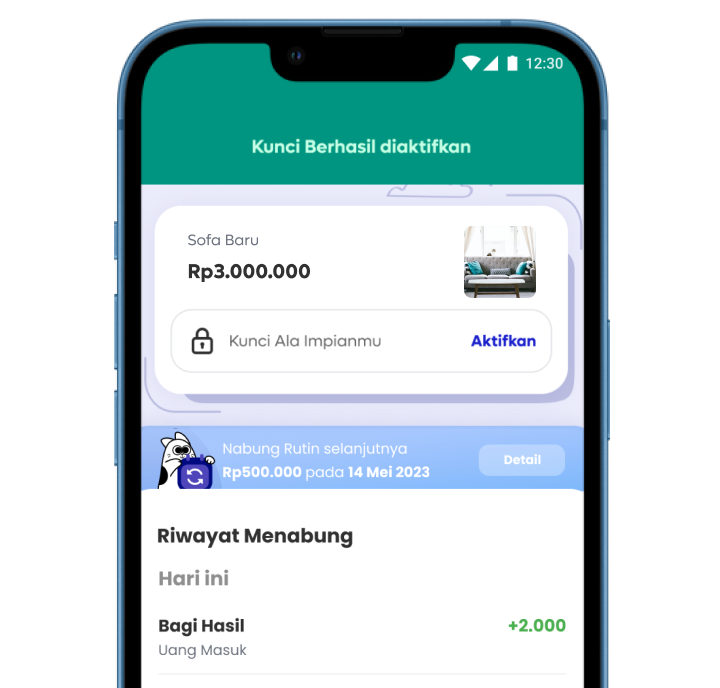

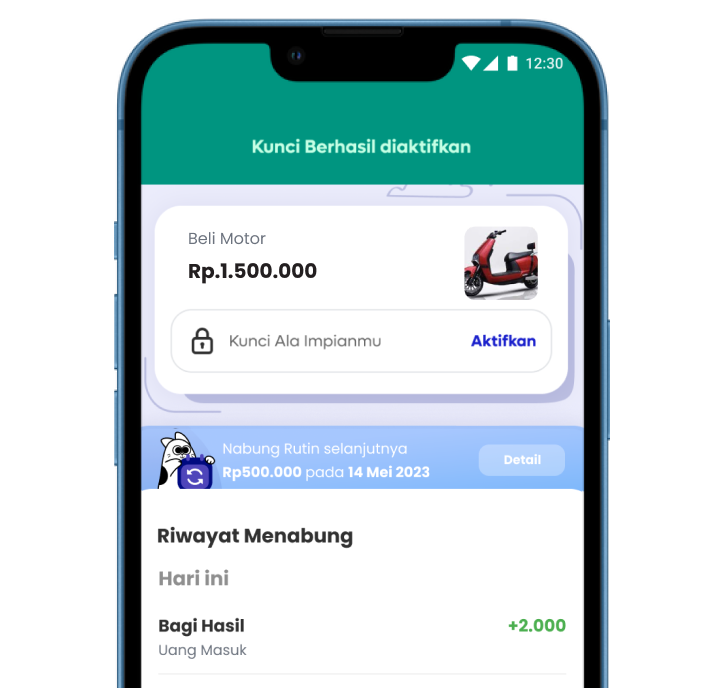

Ala Impian berhasil dikunci! Cek terus dan pastikan target Ala Impianmu tercapai.

Masukkan detail rekening, dan klik Buat Ala Impian

Untuk kamu yang sudah punya Ala Impian, dan ingin mengaktifkan fitur kunci impian, aktifkan fitur kunci impian di menu “Kunci Impian” pada halaman detail rekening atau dari menu “Lainnya”

Pilih “Aktifkan Fitur Kunci” dan atur periode kunci. Minimal periode kunci impian adalah 14 hari

Ala Impian berhasil dikunci! Jangan lupa tambah terus saldo Impianmu ya!

Simple Way to Save Up For Your Goals

All you need to do is follow these steps to open your savings account!

FAQ

Ala Impian is a savings product by Bank Aladin Syariah that could help you manage your financial goals. You can create several savings accounts for whatever dreams you want such as for buying new gadgets, your wedding fund, buying a house or going on Umrah. You can also customize and manage your dream savings through our app. For you who haven't discovered their dream yet, you can still create an Ala Impian account to help with your savings routine or even for an emergency fund.

One thing that differentiate Ala Dompet with Ala Impian is the purpose of the fund you save. Ala Dompet makes it easy for you to manage your daily transaction. With a GPN debit card, you can easily make cash withdrawal at any ATM network or even make payment on EDC machines.

Meanwhile, Ala Impian can help you manage your savings and make your long-term or short-term dreams come true. By having an Ala Impian account, you can easily set your own financial goals so you can save more easily and regularly. What's more, since Ala Impian focuses more as a savings account, Aladin can provide higher profit sharing for your Ala Impian savings.

Ala Impian uses a mudharabah mutlaqah contract (unrestricted investment account).

Whether your Ala Impian has a goal or not, profit sharing will be shared on the 1st of each month.

Sure you can! If you’re still unsure about your dream and just want to save for an emergency fund or to just simply separate your savings accounts from your transaction account, you could still create an Ala Impian account by selecting the "Saving Without Purpose" option.